|

Bob Moore Cadillac wants to save you money on your next vehicle purchase. That’s why we want to let you know about Tax Section 179.

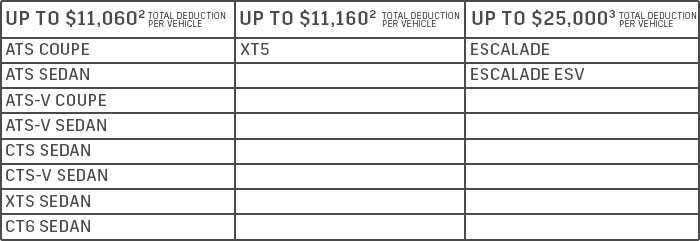

Under new tax code guidelines, small business owners who invest in new equipment such as Cadillac sedans or SUVs are eligible to write off up to $25,000* of these purchases on their 2017 tax returns.

But you have to act fast! To qualify, you must purchase a select Cadillac sedan or SUV before midnight, Dec. 31, 2017. The title of the vehicle or fleet of vehicles must also be in your company’s name and be used for business purposes at least 50% of the time.

|

|

*1. Each individual’s tax situation is unique; therefore, please consult your tax professional to confirm vehicle depreciation deduction and tax benefits. The tax incentives are available for depreciable tangible property that is acquired by purchase for use in the active conduct of a trade or business. Additional limitation based on purchases. For the 2017 tax year, the aggregate deduction of $500,000 under Internal Revenue Code Section 179 is most beneficial to small businesses that place in service no more than $2,010,000 of “Section 179 property” during the year. For every dollar spent on Section 179 property in excess of the overall limit of $2,010,000, the $500,000 expense-tax deduction decreases by a dollar. Certain vehicles, models, and restrictions apply. Consult your tax professional for details. For more details, visit www.irs. gov. 2. For vehicles that qualify as passenger automobiles under the Internal Revenue Code, there is a $11,060 per-vehicle depreciation deduction cap or $11,160 for certain SUVs, trucks, and vans placed in service during 2017. 3. For vehicles that qualify as sport utility vehicles, including certain trucks and vans, under the Internal Revenue Code, the maximum amount that may be expensed is $25,000 of the total purchase price. The $25,000 expense cap contributes to the $500,000 dollar limit and $2,010,000 investment limit under Section 179. ©2017 General Motors. Cadillac® ATS® CT6® CTS® Escalade® SRX® XT5® XTS®

|

|

Don’t wait! The time to buy is now. For more information about these deductions, click the button or get to Bob Moore Cadillac today

|

|

|

Bob Moore Cadillac of Edmond | 13020 N. Broadway Ext., Oklahoma City, OK 73114

Bob Moore Cadillac of Norman | 6400 N Interstate Dr., Norman, OK 73072

Sales Number (888) 876-9554 | Service Number (888) 341-6021

|