Small Business Owners Save

Tax Section 179 is your ticket to huge tax deductions! Small business owners can claim full purchase price of select GMC vehicles totaling up to $510,000 as a tax deduction.

To qualify, the eligible vehicle title must be in the company name and used for business related purposes 50 percent of the time.

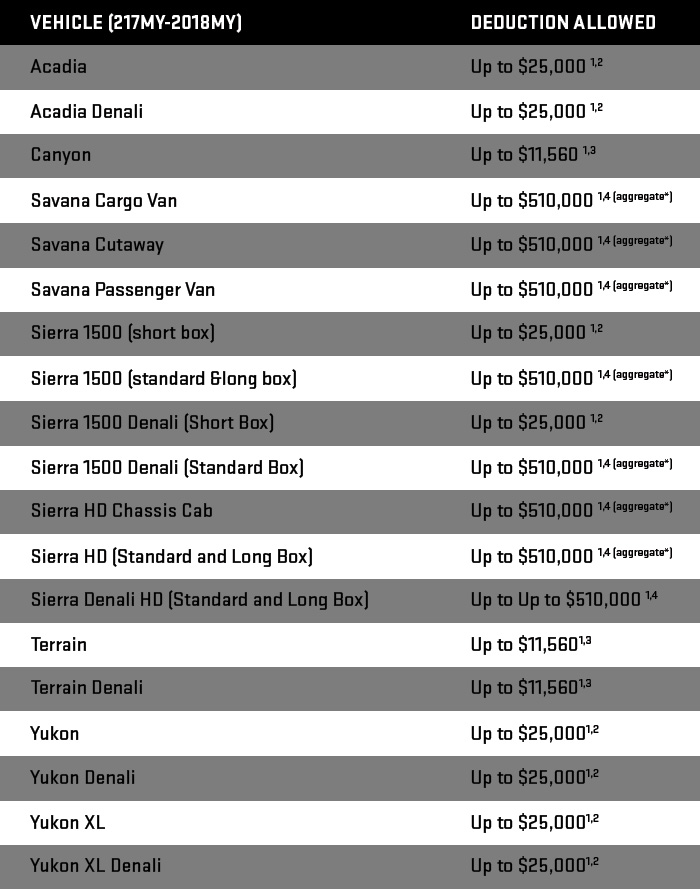

See the chart below to see just how much you'll save!

Tax Deduction Eligibility

|

|

|

This is your chance to save big in 2017! Don't miss out!

Click the button, then hurry in to Crown Buick GMC to see just how much you can save!

|

**1 Each individual’s tax situation is unique. Therefore, please consult your tax professional to confirm vehicle depreciation deduction and tax benefits. For more details, visit irs.gov. 2 For vehicles that qualify as sport utility vehicles, including certain trucks and vans, under the Internal Revenue Code, the maximum amount that may be expensed is $25,000 of the total purchase price. The $25,000 expense cap contributes to the $510,000-dollar limit and $2,030,000 investment limit under Section 179. 3 For vehicles that qualify as passenger automobiles under the Internal Revenue Code, there is a $11,560 per-vehicle depreciation deduction cap for certain SUVs, trucks, and vans placed in service during 2017. 4 The tax incentives are available for depreciable tangible property that is acquired by purchase for use in the active conduct of a trade or business. Additional limitation based on purchases. For the 2017 tax year, the aggregate deduction of $510,000 under Internal Revenue Code Section 179 is most beneficial to small businesses that place in service no more than $2,030,000 of Section 179 property during the year. For every dollar spent on Section 179 property in excess of the overall limit of $2,030,000, the $510,000 expense-tax deduction decreases by a dollar. Certain vehicles, models, and restrictions apply. Consult your tax professional for details. Vehicles must be placed in service in the 2017 tax year to be eligible. * Total deduction aggregate; no per-vehicle purchase price limit.

|

|