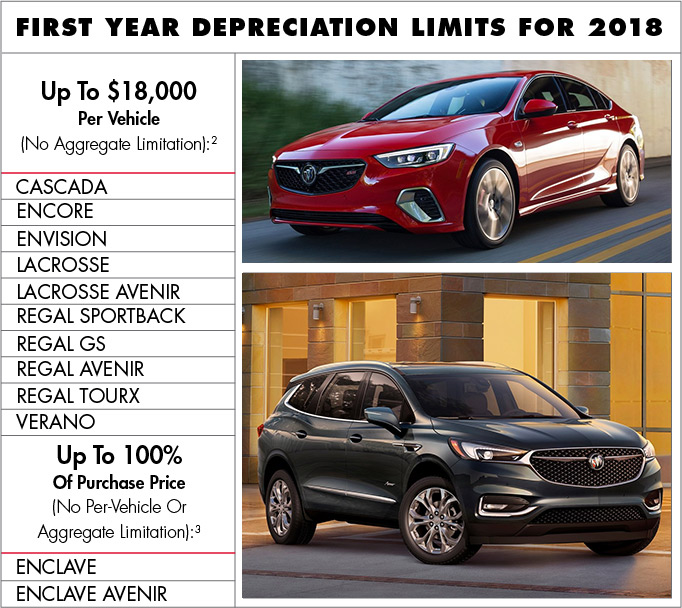

Qualifying Buick Deals

|

|

But you need to hurry; this only applies to Buick vehicles purchased this year!

Get to Crown Buick GMC today! A Better Way To Buy A Car!

|

|

|

1Federal tax benefits are available for vehicles acquired for use in the active conduct of trade or business and may change or be eliminated at any time without notice and each taxpayer's tax situation is unique; therefore, please consult your tax professional to confirm available vehicle depreciation deductions and tax benefits. For more information, visit www.irs.gov. This advertisement is for informational purposes only, and should not be construed as tax advice, or as a promise of availability or amount of any potential tax benefit or reduced tax liability.

2Passenger automobiles, as defined in the Internal Revenue Code (including SUVs, trucks and crossovers with a GVWR up to 6,000 lbs.), and placed in service during 2018 qualify for immediate depreciation deductions of up to $18,000 per vehicle.

3Trucks, vans and sport utility vehicles as defined in the Internal Revenue Code with a GVWR over 6,000 lbs. and placed in service during 2018 qualify for immediate depreciation deductions of up to 100% of the purchase price. |