Small Business Owners Save

Tax Section 179 is your ticket to huge tax deductions! Small business owners can claim full purchase price of select RAM vehicles totaling up to $510,000 as a tax deduction.

To qualify, the eligible vehicle title must be in the company name and used for business related purposes 50 percent of the time.

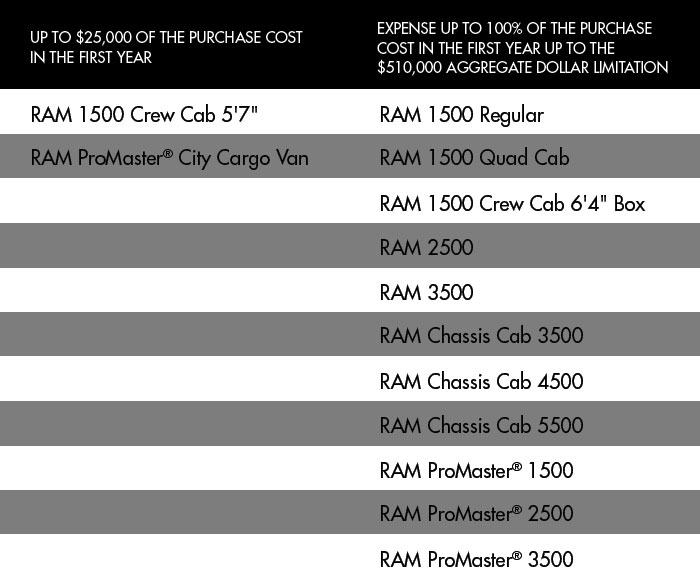

See the chart below to see just how much you'll save!

Tax Deduction Eligibility

|

|

This is your chance to save big in 2017! Don't miss out!

Click the button, then hurry in to Crown CDJR Dublin to see just how much you can save!

|

**ProMaster City passenger van may be eligible for up to $11,560 in total deductions in year 1. The listed property expensing restrictions provided in Section 280F do not apply to a vehicle that is considered to be a qualified nonpersonal use vehicle. A qualified nonpersonal use vehicle is by virtue of its nature or design not likely to be used more than a de minimis amount for personal purposes. For more information, see Income Tax Regulation Section 1.280F-6(c)(3)(iii), Income Tax Regulation Section 1.274-5(k)(7), Publication 946 - How to Depreciate Property and consult your tax advisor as to the proper tax treatment of all business-vehicle purchases. Must purchase vehicle before December 31, 2017.

|

|